MINERVA THE NEXT NEXT PRESALE & ICO

Here again, another important announcement about upcoming projects and the launch of the new MINERVA TOKEN (OWL) supported by blockchain technology.

Very soon, it will announce their pre-sale tokens, you must register via the link to get the update first, which I give below:

https://minerva.com

What is Minerva:

It is the world's first inverted Merchant processor. The main goal is to make the use of crypto currency in the mainstream. Today, merchants do not accept any crypto currency as payment method because of the high volatility in this currency market. To eliminate such risks, this has been designed in such a way that while accepting payments by OWL Token the merchants will be reimbursed. Minerva does not charge a transaction fee, but pays to use it. This is the fundamental difference between the traditional payment method. So, to say that smart money built on a smart contract on the Ethereum blockchain network.

OWL OF THE MINERVA BACKGROUND:

The owls were the first widely used international coin.

These thick, heavy silver coins, minted over 2500 years ago, were

arguably the most influential of all coins. Through careful control, Owls

became known for its high quality and consistent weight, allowing

merchants to use them for portability and overall acceptance. They

have been produced for more than four hundred years, and remain

the most widely recognized ancient coin among the general public today.

So now he is ready to come back with a new look and new strengths. To learn more, you can read the white paper for the entire project.

Minerva is a platform built on the Ethereum block chain and its cryptocurrency is the OWL ERC20 token. Minerva's goal is to solve cryptocurrency adoption problems and provide partner companies with incentive payment solutions.

Minerva pays the transaction fees to companies, we do not charge them. We discuss cryptocurrency adoption issues by introducing disruptive trade disbursement solutions to accelerate the widespread adoption of cryptocurrency and smart contracts. Minerva is the world's first reverse commerce processor.

New cryptocurrencies are introduced almost daily and their values can grow exponentially from the beginning. At the same time, many are abandoned after their novelty and "honeymoon" market, eventually quickly break down from significant use. Despite these nascent characteristics of the cryptocurrency market, it is clear that several statistical properties of the cryptocurrency market have been stable for years. The number of active cryptocurrencies, the distribution of market shares and the turnover of cryptocurrencies remain fairly predictable.

Adopting a mathematical perspective, we see a neutral model of the cryptocurrency economy. This allows gleaning ideas based on clear empirical observations, despite the varying advantages and disadvantages of one cryptocurrency over another. We used this research to discover unique properties and factors important to understanding how cryptocurrencies provide value to end users and long-term token holders.

- What if Ripple provided a unique advantage to companiesin sectors other than banks and other financial institutions?

- And if Bitcoin was not controlled almost exclusively byspeculation?

- And if the Ethereum mining rewards went to companies thataccepted it as payment and that were accumulated by the platforms?

TECHNOLOGY:

Minerva is currently an ERC20 token and smart contract system built on the Ethereum blockchain. Following this standard, Minerva tokens are easily transferable between users and platforms using ERC20-compatible portfolios, and can be easily integrated into exchanges.

SERVICE AND APPLICATION LAYER:

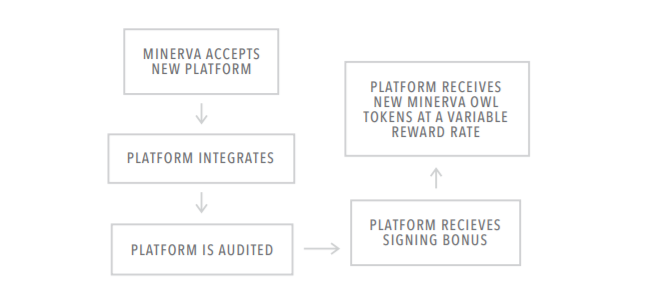

Some OWL tokens will be held and issued to companies as a "signature bonus" with a slow release algorithm and distributed on a first-come, first-served basis at 5% of the premium to a point where the safe becomes almost exhausted and a signature bonus of 5% is fiscally inconsequential.

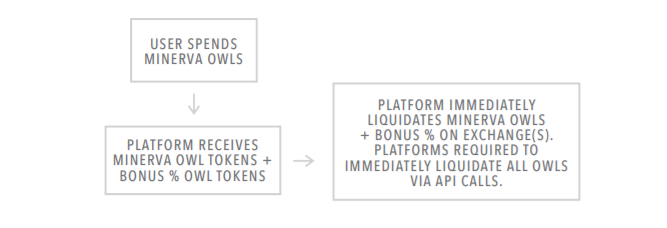

Minerva uses two advanced methods to increase and decrease the OWL token offer. The first method hits Minerva's new OWL tokens and inserts them into the economy when a partner platform accepts the token as a payment method. The rate at which OWL tokens currently enter the economy is called the "reward rate". The reward rate is directly proportional to the price of OWL: when the price increases, the reward rate increases. The reward rate will increase until it sufficiently increases the total supply to avoid violent price fluctuations in the short term. When the reward rate is greater than zero (0), a small portion of the reward is sent to a contract where it can be exchanged for Minerva Volatility Protocol Tokens (MVP) and voting tokens.

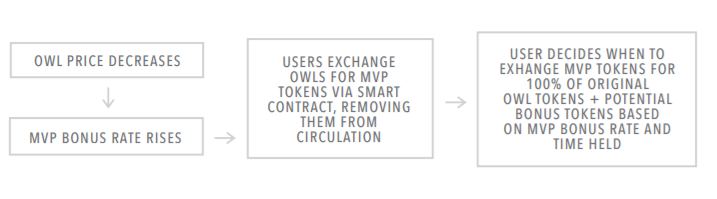

The second method sterilizes Minerva OWL tokens when their price decreases. Instead of a negative reward rate, we adopt a system that encourages users to temporarily withdraw their OWL tokens from the economy. Users will exchange OWL tokens for MVP tokens representing a number of OWL tokens that can (or can not) appreciate over a period of time. In all cases of price declines, MVP tokens will be sold, but the larger the price decrease at the time of purchase, the higher the potential appreciation value of these tokens. These MVP Tokens may be redeemed at a later date against the original OWL tokens paid in addition to a certain additional percentage.

Voting is based on a SchellingCoin point-based SchellingCoin method by Vitalik Buterin, but modified to be more tamper-resistant (explained later), to determine the approximate Minerva / USD conversion rate. In addition to the normal transfer of OWL tokens, users will be able to use a function that allows the transfer of tokens and voting within a single transaction. Because of this "piggyback", the vote will have a minimal cost of gas (transaction costs). In exchange for the vote, voters will be allocated a specific number of voting tokens correlated to their Minerva deposit deposited for voting.

Minerva uses four key methods to deter voter manipulation:

- A deposit is required to vote; the deposit is the influence of the participant's vote on Minerva's "contract price" and the deposit determines the reward received for the vote. This deposit will be lost if the vote is deemed illegitimate.

- A "votechain" is used in this process. The votechain makes it possible to judge more of the validity of past votes as new votes are entered. When a participant votes on the current price, they are also asked to enter the price of the selected past moments. These votes are then compared to the votes previously cast and the votes deemed illegitimate will lose their deposit. "Illegitimate votes" are defined as not falling between the 25th and 75th percentiles given sufficient sample size.

- If the number of votes is sufficient, all the votes cast are rewarded, while only a certain percentage is allowed to influence the price of the Minerva contract.

- Open-source exchange polling and polling automation with real-time log output as a security mechanism. This protection is enabled only if it is presented with evidence of a sophisticated attack occurring on the Minerva Volatility Protocol.

CASE OF IMMEDIATE USE:

The first company to integrate into Minerva's economy is a live streaming service with revenues of $ 20 million and more than 10 million users. We will show a clean and concise impact on revenue before and after integration with Minerva. At this time, Minerva was advised to temporarily retain the name of our first corporate partner. We aim to integrate a wide range of large niche and mainstream businesses spanning multiple industries by recruiting platforms into the Minerva Smart Money Alliance (MSMA).

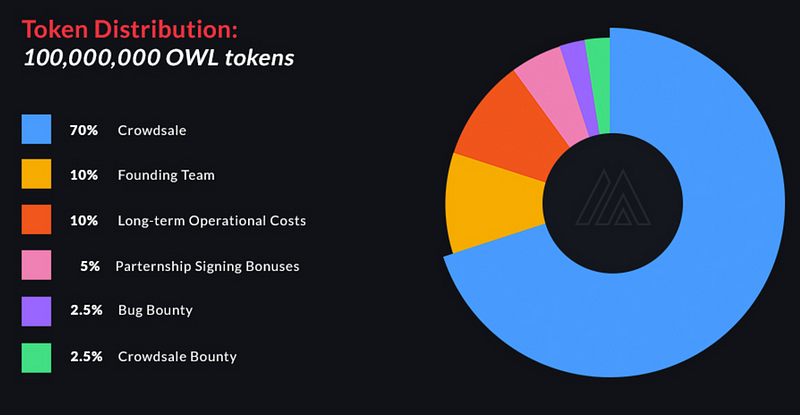

The participation of the first members is via a crowdsale dashboard accessible via Minerva.com. 75,000,000 of the initial 100,000 Minerva OWL chips will be distributed in two crowdsales. A pre-sale is followed by a primary Minerva Crowdsale, and each is accessible to parties outside the United States.

The crowdsales will take place in the form of an auction in which all distributed Minerva will be priced according to the amount of the contributions received, and then distributed accordingly. 25,000,000 Minerva will be excluded from the crowdsales that are described below in the "Reserve Minerva" section. After the creation of the initial 100,000 OWL tokens, the creation of new tokens, with the exception of the bonuses associated with the platform utility, will be permanently stopped. In the year (365 days) of the crowdsale, an announcement will be made about all potential 1: 1 token exchanges for any proposed private blockchain migration.

PRE-SALE:

We will have a symbolic pre-sale and it is likely to be private.

CROWDSALE FINAL PRIMARY:

After the symbolic presale, the primary and final crowdsale will take place

MINERVA RESERVE:

At the end of crowdsales, the founding team will receive a 10% allocation of OWL tokens, subject to a 12-month holding period (12 months). These tokens will serve as an incentive for long-term performance for the founding team. An additional 10% will be allocated for long-term operating costs, 2.5% will be allocated for partnerships and an additional 2.5% for the bounty bug program. All Minerva OWL token transfers will be restricted for two (2) months after the end of the crowdsale.

ROAD MAP:

INTERNALLY FINANCED

- Development of the basic platform

- Simulations of the internal market

- Integration tests / Compliance

- Content Translation

- Exchange ads

- Jural advisor

- Initial security audit

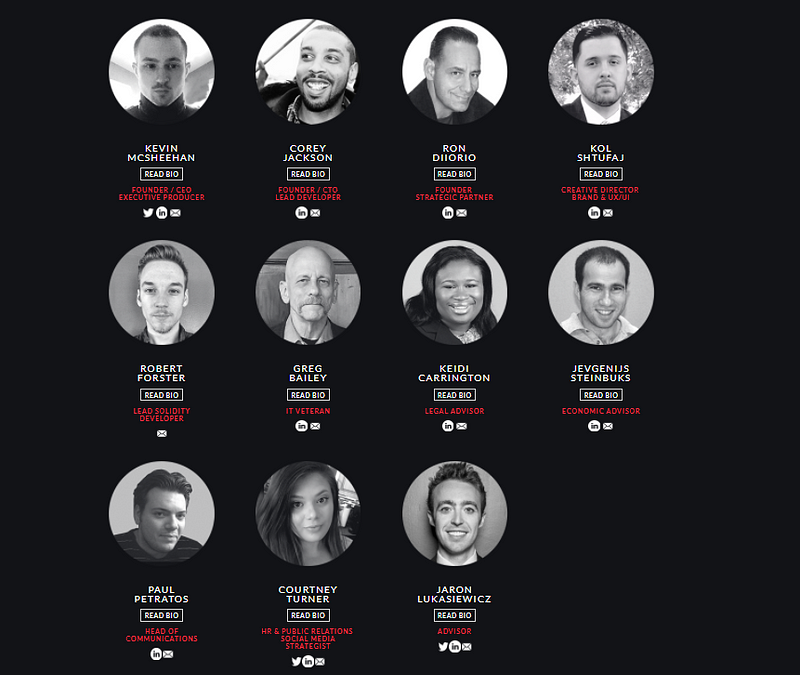

In this project is filled by people who are professionals who are experts in their field:

For the official information of Minerva:

Website: https://minerva.com/

White Paper: https://minerva.com/whitepaper.pdf

Facebook: https://www.facebook.com/MinervaToken/

Twitter: https://twitter.com/minervatoken

Telegram: https://t.me/minervachat

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1033626

Emoticon